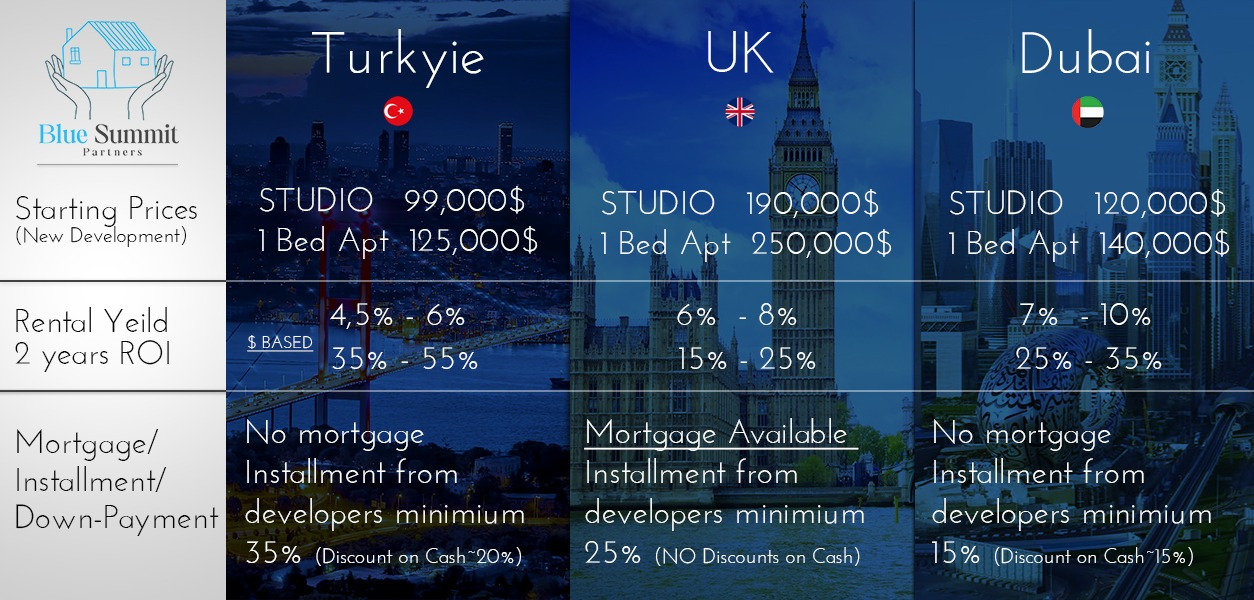

How Each Market Weathered Economic Shifts in the UK, Turkey, and Dubai

The global real estate landscape is ever-evolving, navigating through economic fluctuations, geopolitical changes, and market dynamics. Examining the resilience of real estate markets in different regions provides insights into their ability to withstand challenges. Let’s explore how the real estate sectors in the UK, Turkey, and Dubai have weathered economic shifts and emerged as robust contenders in their respective landscapes.

The United Kingdom: Stability Amidst Uncertainties

Brexit and Market Adaptability

The UK’s real estate market faced uncertainties due to the prolonged process of Brexit. However, its resilience shone through as the market adapted to changing conditions. While initial phases saw fluctuations and cautious investor sentiment, stability gradually returned, showcasing the market’s ability to withstand geopolitical upheavals.

Property Diversity and Demand

The diversity of property types in cities like London and Manchester contributed to stability. Despite occasional fluctuations, the demand for residential and commercial properties remained strong, supported by well-established markets and consistent interest from domestic and international investors.

Turkey: Geopolitical Challenges and Adaptation

Geopolitical Tensions and Economic Impact

Turkey faced geopolitical tensions that occasionally affected its real estate sector. Despite these challenges, the market exhibited adaptability. The country’s strategic location and investor-friendly policies, such as citizenship by investment, sustained investor interest, mitigating some economic impacts.

Growth Potential and Affordability

Turkey’s real estate market, known for its affordability compared to many European counterparts, continued to attract investors seeking growth potential. Key cities like Istanbul showcased resilience by maintaining demand for both residential and commercial properties.

Dubai: Volatility and Long-Term Vision

Market Volatility and Adaptive Measures

Dubai’s real estate market experienced volatility, notably during the late 2000s crash. However, the Emirate’s long-term vision and adaptive measures steered recovery. The market diversified offerings, emphasizing sustainable growth and infrastructure development.

Luxury Segment and Long-Term Investments

Dubai’s luxury segment faced fluctuations but demonstrated stability in the long run. The city’s commitment to ambitious projects, coupled with its tax-free environment, sustained investor interest, particularly among high-net-worth individuals.

Lessons in Resilience and Adaptability

Market Diversity and Regulatory Frameworks

The resilience of these markets stems from diverse property offerings, investor-friendly policies, and established regulatory frameworks. The ability to adapt to economic shifts and geopolitical challenges underscores their strength.

Long-Term Vision and Adaptation

Each market showcased resilience by aligning with long-term visions, adapting to changing conditions, and emphasizing stability amidst uncertainties, showcasing their ability to weather economic storms.

Conclusion: Resilience as a Hallmark of Progress

The real estate markets in the UK, Turkey, and Dubai exemplify resilience amidst economic shifts. Their ability to navigate uncertainties, leverage strengths, and adapt to changing landscapes underscores their significance as robust players in the global real estate arena.

As these markets continue to evolve, their resilience stands as a testament to their adaptability, diversity, and long-term vision, positioning them as attractive destinations for investors seeking stability and growth opportunities.